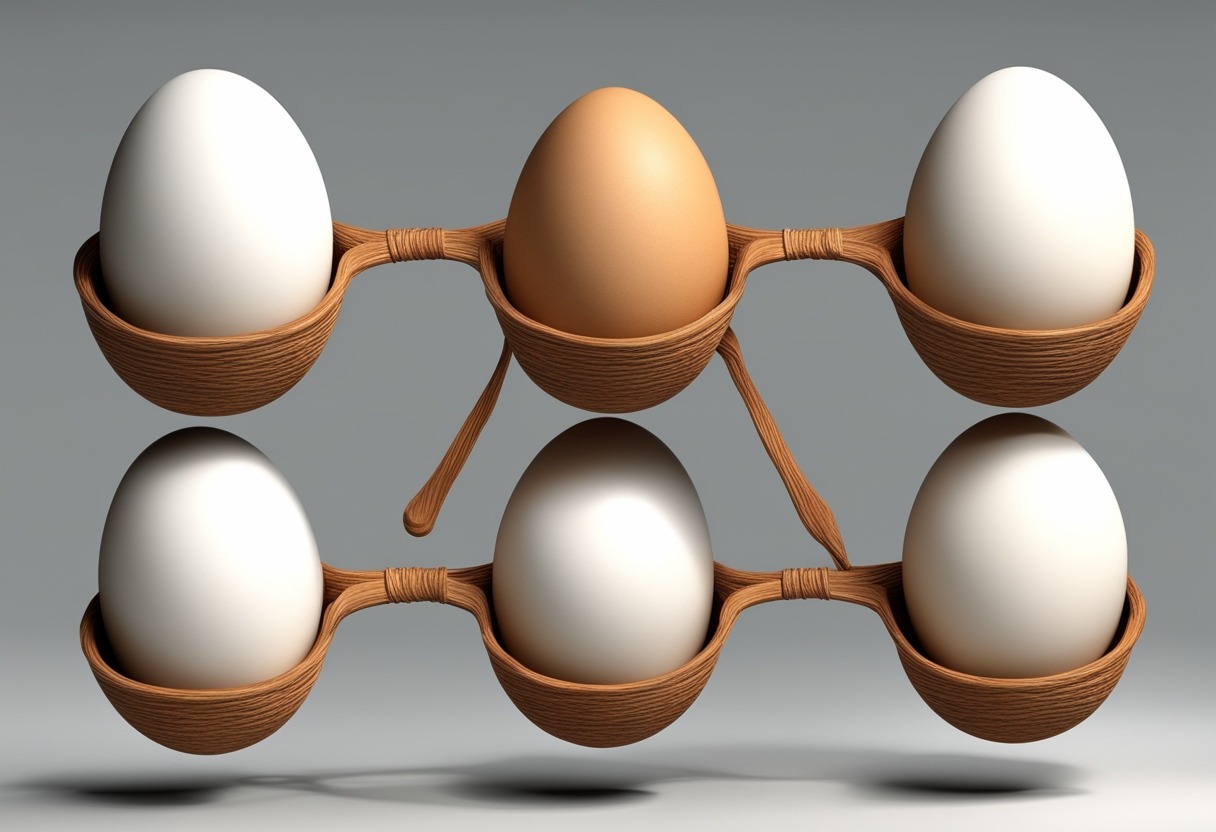

Every investor faces a crucial question: how to structure their portfolio? It’s a balancing act, like juggling eggs (hopefully, your investment returns, not the actual fragile kind). Should you spread them out across a bunch of baskets (diversification), or pile them all into one, super-secure basket (concentration)? Let’s crack open the pros and cons of each approach.

Imagine your portfolio as a breakfast buffet. You’ve got fluffy pancakes (stocks), crispy bacon (bonds), and maybe some exotic dragon fruit (emerging markets) for a bit of adventure. Diversification is all about spreading your investments across different asset classes, like a well-rounded breakfast that keeps you energized for the investing marathon.

Diversification: Don’t Put All Your Eggs (Investments) in One Basket

Benefits of Diversification:

- Risk Be Gone! (Well, Reduced at Least): The market can be a fickle beast, but diversification acts like a suit of financial armor. When one asset class throws a tantrum (looking at you, tech stocks in 2000), others might be calmly sipping tea (hello, bonds). This helps smooth out the overall rollercoaster ride of your portfolio.

- Mr. Smooth Returns: A diversified portfolio is like a seasoned investor – experienced and collected. It aims for steady, predictable returns, avoiding those heart-stopping drops that make you want to hide under the bed.

- Preserving Your Precious Nest Egg: Let’s face it, nobody wants to see their hard-earned cash vanish. Diversification helps protect a good chunk of your capital from taking a nosedive, making it a wise friend for cautious investors.

- Growth on Multiple Fronts: By having a finger in various investment pies, you can benefit from growth across different sectors. Think of it like planting seeds in a diverse garden – you’re more likely to have a bountiful harvest (of returns) come fall.

Drawbacks of Diversification:

- Taming the High Return Dream Horse: While diversification keeps things stable, it might also rein in the potential for super-high returns. You might not win the investment derby, but you’re also less likely to get trampled.

- The Drag of Underperformers: Sometimes, even the best-laid plans go awry. A diversified portfolio might include assets that just aren’t pulling their weight. It’s like having soggy toast at your breakfast buffet – a bit of a mood killer.

- Research, Rinse, Repeat: Keeping a diversified portfolio in tip-top shape requires constant monitoring and research. Think of it as the price you pay for a well-rounded financial breakfast.

Concentration: Putting All Your Eggs (Investments) in One Basket (But a Really, Really Nice Basket)

Concentration is the investment equivalent of going all-in at a casino (hopefully with a well-thought-out strategy, unlike your cousin Gary). You pick a limited number of assets or sectors that you believe are destined for greatness and pour your resources into them. It’s a high-risk, high-reward strategy, best suited for investors with nerves of steel and a deep understanding of their chosen basket.

Upsides of Concentration:

- Return Rocket Ride: If you pick the right basket (think FAANG stocks a few years back), concentration can propel your portfolio to new heights. It’s like having a racehorse with a winning streak – pure investment adrenaline!

- Knowing Your Stuff (Like, Really Knowing Your Stuff): With fewer assets to manage, you can become an expert on your chosen field. Imagine being the Michael Jordan of, say, sneaker company stocks – a true investing legend.

- Less Time Spent Basket Weaving: Concentration frees up your time for in-depth research and analysis. No more getting tangled up in managing a dozen different investment baskets.

Downsides of Concentration:

- Falling with a Thud: If your chosen basket takes a tumble (remember the dot-com bubble burst?), your entire portfolio could be left with some serious egg on its face (financially speaking).

- Market Mayhem Multiplier: Concentration makes your portfolio super sensitive to market fluctuations. It’s like riding a bucking bronco – exciting, but not for the faint of heart.

- Missing Out on the Buffet: By focusing on a few things, you might miss out on potential growth opportunities in other sectors. It’s like skipping the waffles at the breakfast buffet – you might be denying yourself a delicious (and profitable) experience.

Diversification vs Concentration: The Ultimate Showdown

So, which approach reigns supreme? The truth is, there’s no one-size-fits